Already a homeowner? Share these guides with somebody you know will be a first-time homebuyer within the next couple of years.

Entering the real estate market as a first-time homebuyer can feel overwhelming, especially in a highly desirable and ultra-competitive area like Orange County. To help simplify the process and maximize your investment, here are some essential tips that every first-time homebuyer should consider.

Understand Your Budget

Before beginning your home search, it’s crucial to understand how much home you can realistically afford. Consider your monthly income, existing debts, future financial goals, and lifestyle. Be sure to factor in additional costs such as homeowners insurance, property taxes, HOA fees, utility costs, and maintenance expenses. Yes, even newly built homes will incur maintenance costs.

Pre-Approval is Key

Getting pre-approved for a mortgage gives you a clear idea of your budget and shows sellers that you are serious about purchasing. This could give you a competitive advantage, especially in a hot market like Orange County. In today’s environment, it’s essentially a requirement to have a pre-approval letter from a reputable lender just to even submit an offer. Also remember, what you’re willing to pay per month can be completely different than what you qualify for. Many homebuyers may qualify for more than where their “comfort zone” lies.

Work with a Local Realtor

Working with a local realtor who understands the nuances of the Orange County market can make a significant difference. They can provide insights into different neighborhoods, school districts, property values, and more. And if you’re looking for one… um hello… we’re here to help!

Prioritize Your Needs and Wants

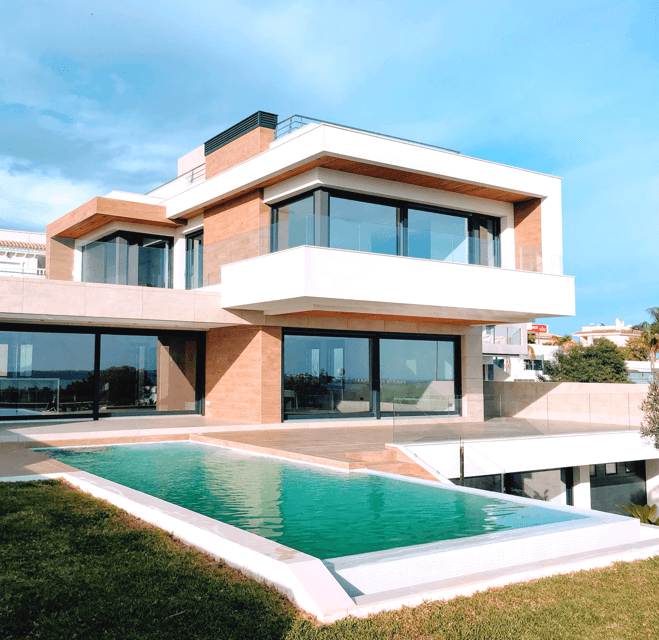

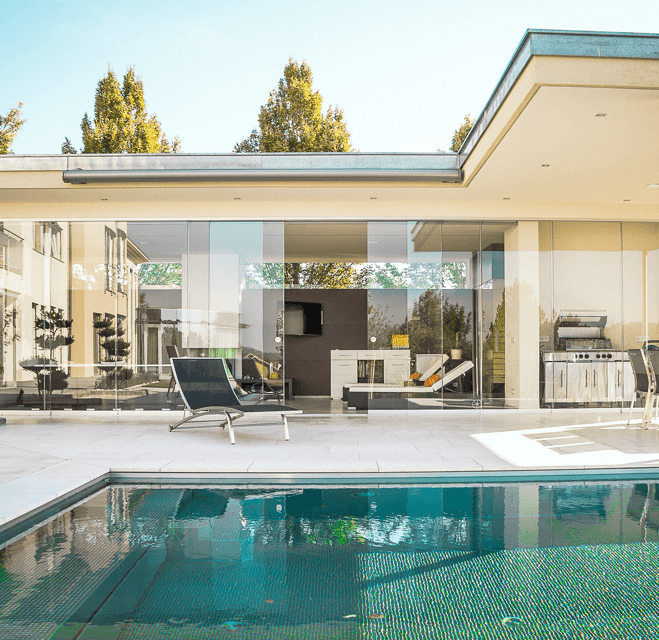

Identify what you need in your first home and what you want. Needs might include proximity to work or family, a certain number of bedrooms, or accessibility features. Wants might include a pool, a large backyard, or a specific architectural style. Knowing the difference will help you make practical decisions during your home search. Here’s a little homework assignment for you – print the following Wants & Needs guide, and send it back to us.

Consider Future Resale Value

While you might be focusing on finding your first home, it’s important to consider its potential resale value. Factors such as location, school district, and the home’s condition can affect future resale value. Think about things like do I want the nicest house in a so-so neighborhood, do I want the so-so home in the nicest neighborhood? More often than not, the nicer neighborhood will be the better investment.

Prepare for Closing Costs

Closing costs typically hover around 2% of the home’s purchase price and can include fees for appraisal, home inspection, title search, lending costs, and more. Be sure to budget for these costs in addition to your down payment.

Stay Patient

Lastly, remember that finding the perfect home takes time, especially in competitive markets. Stay patient, keep an open mind, and remember that minor cosmetic issues can often be easily fixed. This is not a sprint, it’s a marathon. You’re the tortoise in this marathon race. And guess what? The tortoise wins… and you will too.

In Conclusion

As you embark on this exciting journey, remember to share these tips with anyone you know who may be looking to buy their first home in Orange County within the next year or two. A well-informed homebuyer is a successful homebuyer.

If you have any questions or need guidance on your home-buying journey, don’t hesitate to reach out to our team. We’re here to help you navigate the Orange County real estate market and find the perfect home to start your new chapter.

Here’s your guide to buying a home