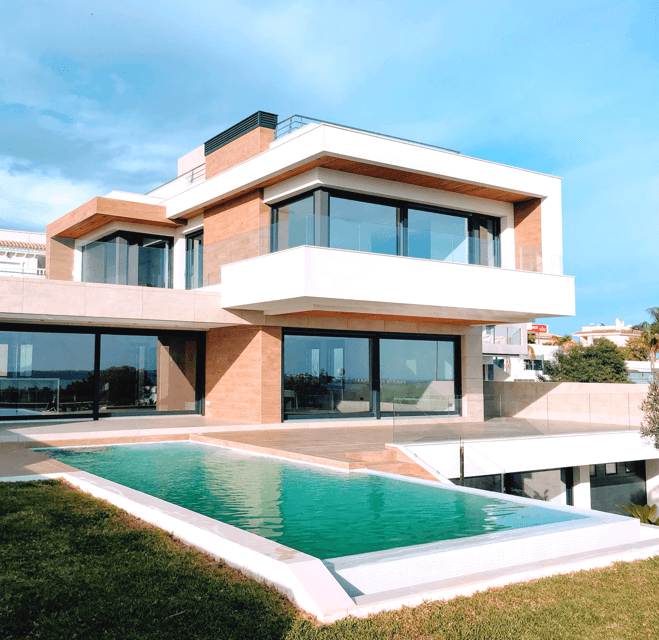

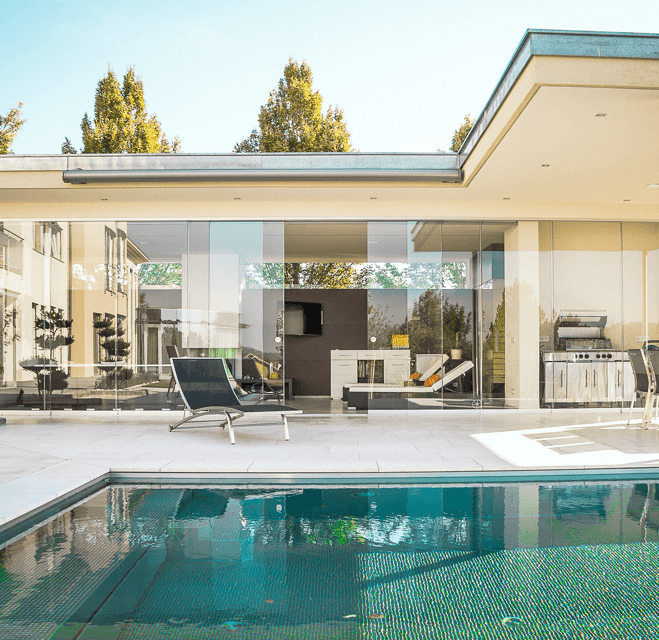

From $.01 to more than $5,000,000+ in 30 days! How one concept can put you in the best position to buy your dream home

Last week’s top Google search was “how to save for a house,” and it got me thinking about how important this topic is for so many of us. Homeownership is part of the American dream, and it’s crucial that we equip ourselves with the right strategies to turn that dream into reality.

Have you heard of the penny example from The Compound Effect?

You start with 1 penny and double it every day for 30 days. By day 30, you’ve amassed $5,368,709.12. Don’t believe me? Check the math below. Nevertheless, small consistent savings (or routines, or habits, or investments) over time, will result in one major change.

The one thing you need to remember is to be patient. On Day 15 of the example below, you will see that you’re not even at $200. You’d probably be thinking at that moment, there’s no way this is going to happen. With less than a week left, you’re not even at $100,000! So how are you going to get $5m+ with 6 days left? Trust the process, staying consistent, and giving it time will get you there.

Apply this method to saving to buy a home. Don’t be discouraged, don’t think it’ll never happen… it will! Give it time, trust the process, watch it work, and begin with the following 5 steps:

1. Start with a Budget

The first step in saving for a house is to understand your income and expenses. Create a budget that tracks your monthly cash inflow and outflow. This will help you to identify potential areas of savings and limit unnecessary expenditures. Remember, you can’t save what you can’t measure!

2. Set Up an Automatic Savings Plan

Next, consider setting up an automatic savings plan. Allocate a specific amount or percentage of your income to go directly into a savings account dedicated to your home fund. This way, you’re consistently building your savings with every paycheck.

3. Think Long Term: Consider Investing

While a savings account is a safe place to park your money, you may also want to consider long-term investments for higher returns. A low-risk investment portfolio could potentially grow your savings more efficiently over time. Please remember to consult with a financial advisor before making any investment decisions.

4. Boost Your Credit Score

Having a high credit score can significantly help you when it comes to securing a mortgage. Lenders will offer lower interest rates to those with good credit, potentially saving you thousands of dollars over the lifetime of your loan. Pay your bills on time, keep your credit card balances low, and avoid taking on new debt to boost your credit score.

5. Cut the Extras

Finally, consider cutting back on non-essential spending. This could mean swapping your daily latte for home-brewed coffee, eating out less often, or canceling unused subscriptions. The savings might seem small at first, but over time, they can add up and make a big difference (hey, just like the penny example).

In Conclusion

Remember, buying a home is a marathon, not a sprint. It requires patience, discipline, and a well-thought-out strategy. Stay focused, and you’ll get there. For more personalized advice, don’t hesitate to reach out. Let’s make that dream home a reality!

Until next time, happy saving!

What happens when you start with $.01 and double every day for 30 days?

| Day | Value |

| 1 | $0.01 |

| 2 | $0.02 |

| 3 | $0.04 |

| 4 | $0.08 |

| 5 | $0.16 |

| 6 | $0.32 |

| 7 | $0.64 |

| 8 | $1.28 |

| 9 | $2.56 |

| 10 | $5.12 |

| 11 | $10.24 |

| 12 | $20.48 |

| 13 | $40.96 |

| 14 | $81.92 |

| 15 | $163.84 |

| 16 | $327.68 |

| 17 | $655.36 |

| 18 | $1,310.72 |

| 19 | $2,621.44 |

| 20 | $5,242.88 |

| 21 | $10,485.76 |

| 22 | $20,971.52 |

| 23 | $41,943.04 |

| 24 | $83,886.08 |

| 25 | $167,772.16 |

| 26 | $335,544.32 |

| 27 | $671,088.64 |

| 28 | $1,342,177.28 |

| 29 | $2,684,354.56 |

| 30 | $5,368,709.12 |