A bursting home price bubble seems imminent, with 78% of Americans believing that a housing market crash is on the horizon according to Consumer Affairs. Of those surveyed, 50% expect it to happen in 2023 and 75% said they would try to buy if it happened. 84% of Gen Z’ers are hoping for a market crash so they can afford to buy. However, despite the anticipation of a market crash, the likelihood is actually low due to the absence of facts supporting a bubble; and the following four realities.

Reality #1

Yes, foreclosure moratoriums have expired, causing an increase in bank-owned homes.

The number of foreclosures in Southern California’s five counties has doubled from 2022 to 2023, but let’s put this in perspective. It is still a relatively small amount compared to the average of 963 foreclosures in Southern California prior to the COVID pandemic. And 4th quarter numbers were down 89% from the 2010 high, after the 2008 bubble burst.

Reality #2

High equity of homeowners, which has resulted in few homes being in delinquency.

Most homeowners who bought before the pandemic, and since 2010, have seen substantial gains in property value. Lending requirements are tighter than a decade ago, making fewer people over-extended. Indeed, some recent buyers who paid over asking price may be vulnerable to foreclosure if they experience significant life events. But this number compared to the overall number of home purchasers in the last 13 years is relatively small. This subset of the homeownership population cannot in and of itself create a trustworthy bubble.

Reality #3

Rental prices are also on the rise

With over 45% of California’s population being renters and the median monthly asking rent in the US increasing 17% year over year. Properties for rent still seem to have multiple applicants. This underscores the shortage of homes available, for rent or purchase.

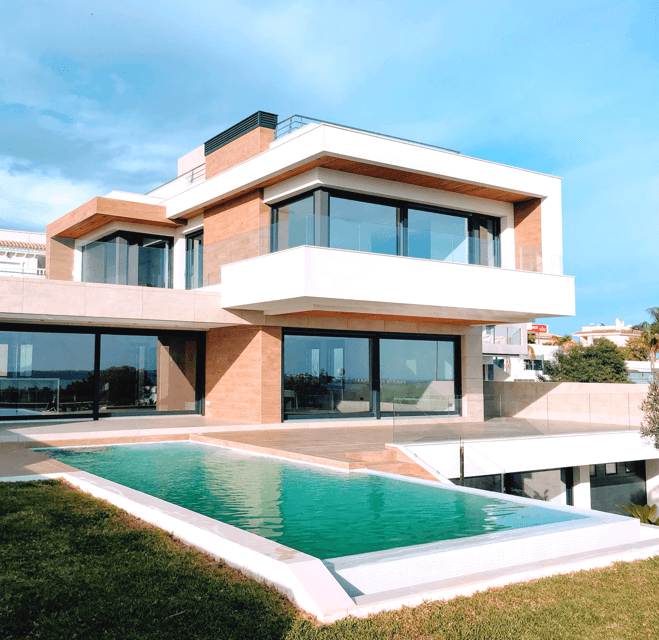

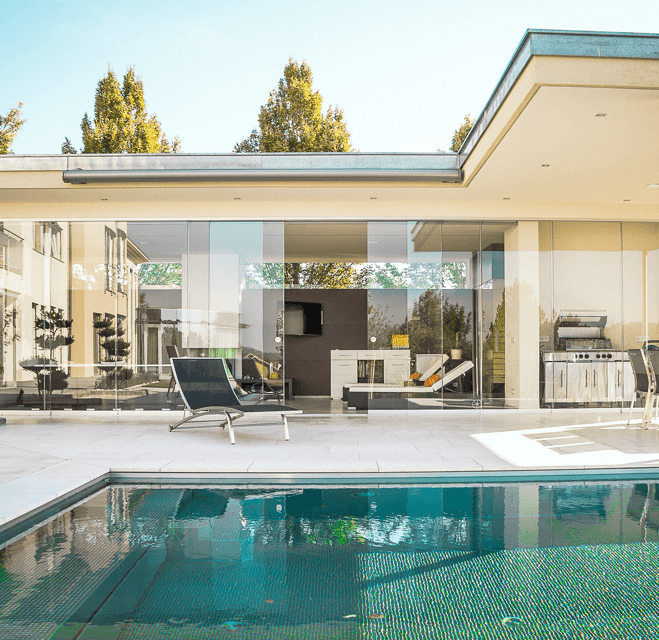

The dream of homeownership is still strong

The fourth reality is simply a ‘boots on the ground observation. Across my Orange County, California marketplace, homes and condos across all price spectrums priced at perceived market value are selling briskly with multiple offers and in some cases bid up higher. Demand for the American Dream of homeownership is strong, as serious buyers adjust and budget to the reality of 5%+ interest rates.

In conclusion

Yes….. prices are still high and interest rates are higher than they have been for over a decade, definitely causing uncertainty in the market. Hey, who wouldn’t want lower prices and rates? But for those waiting for a bubble to burst, the factors noted above really don’t even indicate the existence of a bubble.